A Profit Center Operating Budget May Be Expected to Show:

Operating costs and revenues C. In the business finance world budgets get a bad rep.

Shop Local Small Business Quotes Shop Local Campaign Locals

Dont forget to pay yourself as the owner each month after figuring out the profit after all the expenses have been calculated and paid for accordingly.

. Both of the above. Operating profit is the profit earned from a firms normal core business operations. An operating budget is a detailed statement showing all the operational expenses and incomes expected during a particular period of time.

Budgeting in a nonprofit organization is important because your mission matters and you need. The operating budget a type of master budget is a detailed statement showing all the operational expenses to be incurred and incomes to be generated during a particular period of time. Sales Budget - the expected product sales and the anticipated selling price per unit during the budget period.

An operating budget plan will help in. An operating budget is also essential for decisions about hiring additional employees determining pay raises and bonuses and for planning benefits packages. Operating budgets show both amounts of money already spent and the expected returns.

Budget your operating expenses. Included in this amount is 1800000 in Capital Improvement Projects. Food costs sales labour overhead profit 247 500 78 750 57 750 15 000.

Account for unexpected expenses. We are 24000 short of having one year of operating expenses in reserve funding. Can cover the next year but are linked to a more futuristic view they can cover 5 or even 10 years period.

In regard to an operating budget identifiable costs may generally include. AOperating costs only B. If we look at their 2018 Form 990 they had 475384887 in grants to US nonprofits and 69269 in grants to foreign nonprofits for an operating budget of 12927177.

Before a companys fiscal year starts an operating budget determines what they need to do to earn the expected profit. Costs that are incurred as part of the manufacturing process but are not clearly traceable to the specific unit of product or. Make a sales budget.

Is adjusted or flexed to the level of output expected to be achieved during the budget period. Increase in Accounts Payable 101300 - 98500 2800. We have a small staff of 5 people and an operationg budget of 325000 a year.

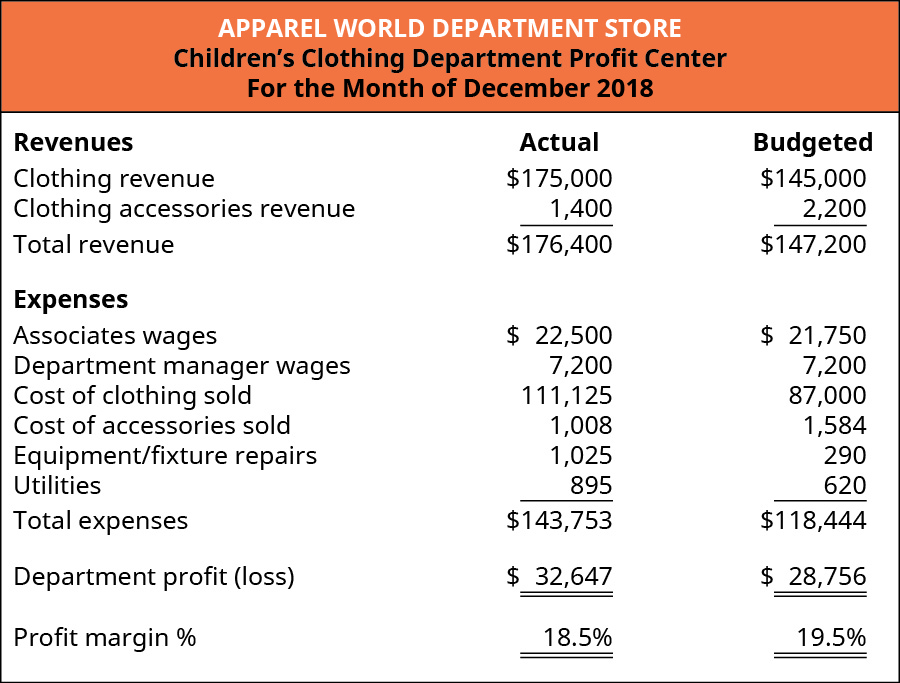

The Operating Budget is composed of a number of smaller budgets. A business may tweak its operating budget throughout the year eg each month to ensure its up-to-date with any operational changes. Question 26 25 25 points A profit center operating budget may be expected to show.

With an income of 409880 and expenses of 240860 you will profit by 169020. This value does not include any profit earned from the firms investments such as earnings from firms in which. November 18 2021.

3 points QUESTION 30 A profit center operating budget may be expected to show. Operating expenses such as expenses on raw material purchases processing cost interest on a loan the salary of the staff maintenance of the office administrative expenses are. Operating revenues are expected to grow by 80 percent.

Is a subunit of the organization that provides services to other centers within the organization. Our goal is to have one year of operating expenses in reserve funding. Production Budget - the required number of units that must be produced to meet the expected sales.

Track your budget vs actuals. Is based on a level of. Which of the following is not considered an operating budget.

Operating costs and capital expenditures D. Operating costs and capital expenditures. Accurate budgeting is critically important to the success of any business and especially important for nonprofit organizations that may have stretched resources fluctuating funding andor heavy reliance on specific funders.

Well go over the basics as well as some advanced budgeting techniques that can be used by a nonprofit. If all the expenses are to be met the restaurant should not. Neither of the above.

Our nonprofit agency has been in existence for 10 years. May be either a cost center or a profit center. The FY 2020 Adopted Budget of 25772000 is 2079000 88 percent greater than the FY 2019 Revised Budget.

Helps to keep track of income and current expenses. This free 4-day email course provides practical tips and suggestions for implementing a budget in your organization and reviewing budget reports. The operating budget is a key tool in effectively and efficiently achieving the organizations stated purpose and should align with.

Cash paid for inventory 545000 7000 - 2800 549200. 7201 Corporate Center Drive Hanover Maryland 21076 4108651000 Maryland Relay TTY 4108597227 mdotmarylandgov J00I00 MDOT Maryland Aviation Administration FY 2022 Operating Budget Response to the Department of Legislative Services Budget Analysis Senate Budget and Taxation Committee. Transient Occupancy Tax is equal to annual debt service budget and an additional 500000.

Creating an operating budget can be beneficial for your small business. This shows the importance of operating budgets because a 13 million organization is very different than a 475 million organization. Therefore an operating budget reveals how much profit an organization will generate given the assumption of revenues and expenses proves right in the future.

It controls how these funds are spent and ensures that the firm works hard enough to meet its set targets. Is a cost center for which management is able to identify the original amount invested. Food costs sales labour overhead profit In the example being developed food costs are.

Deals with actual short-term revenues and expenses necessary to operate the facility - covers the next year 12 month period Capital expenditure budgets. Operating costs and revenues.

Chart Printable Forms Templates Samples Small Business Expenses Expense Sheet Bookkeeping Business

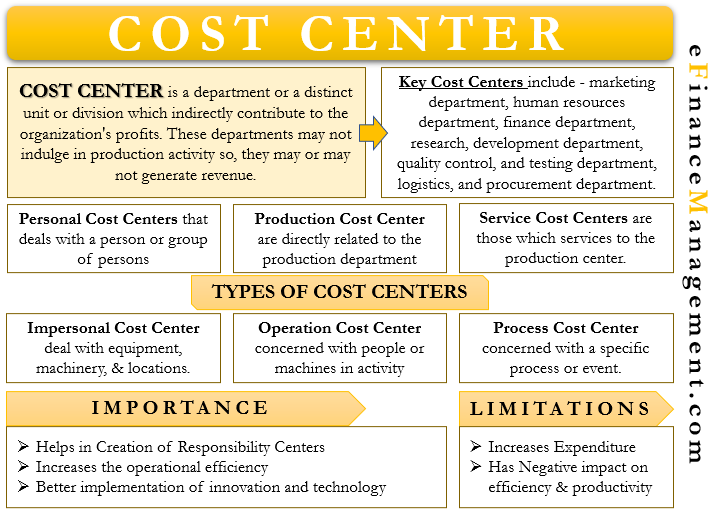

Cost Center Meaning Types Importance Limitations

How To Get Out Of Debt Paying Off Credit Cards Budgeting Money Money Management

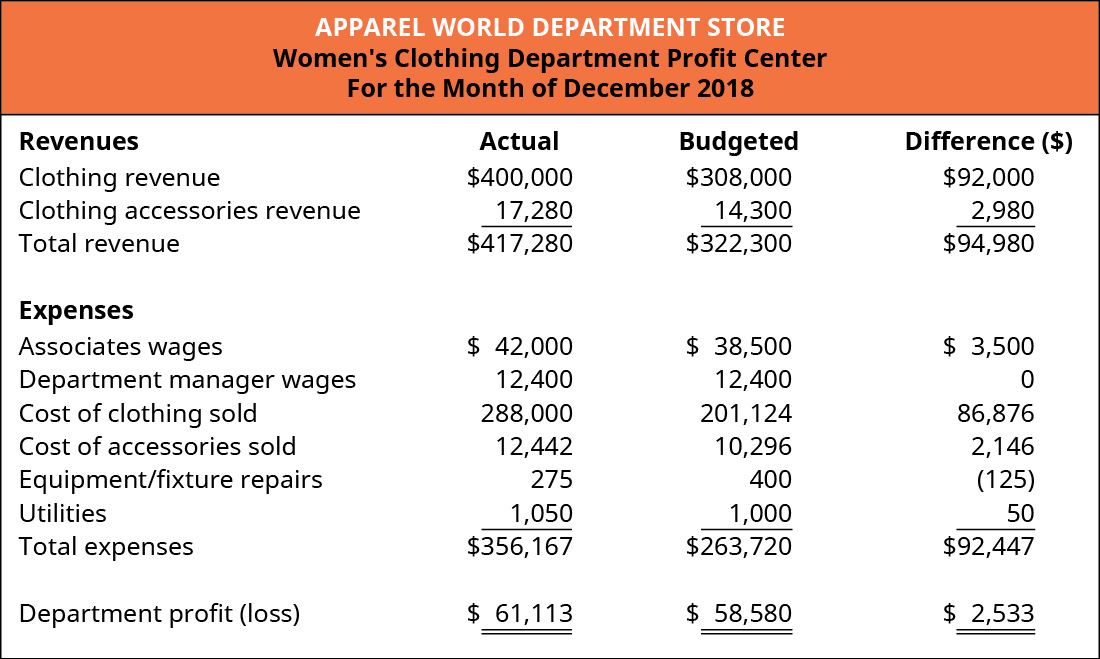

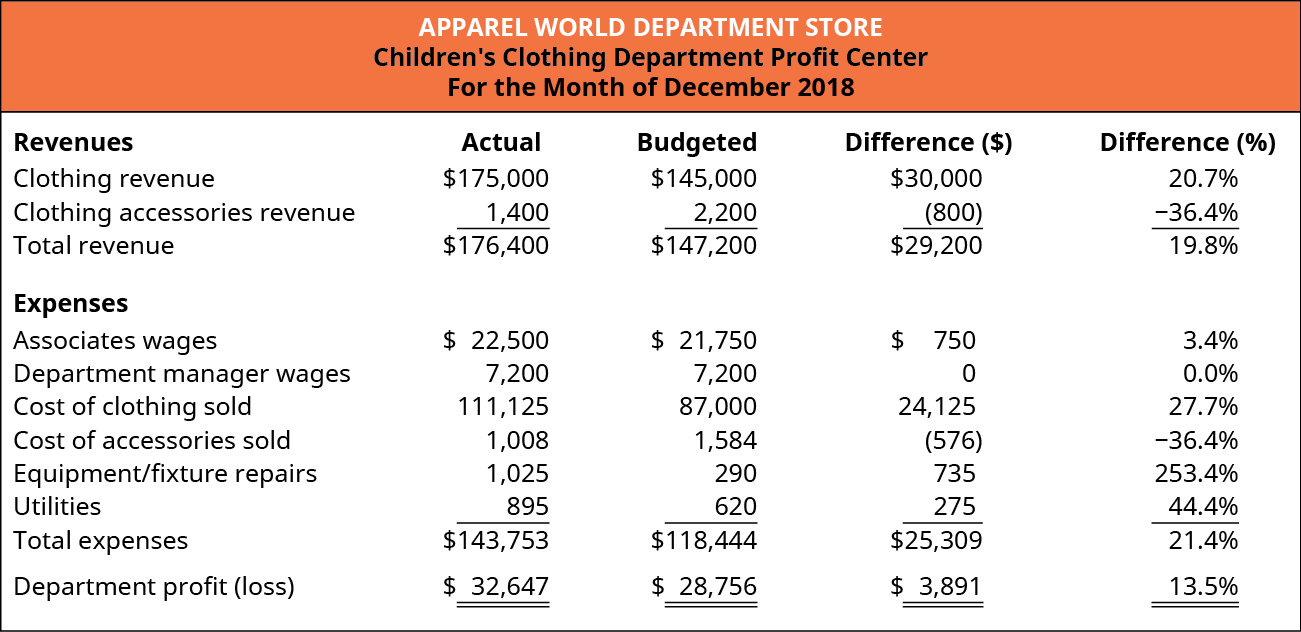

9 4 Responsibility Centers Managerial Accounting

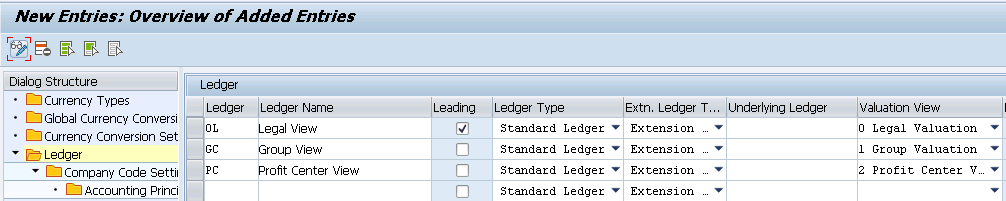

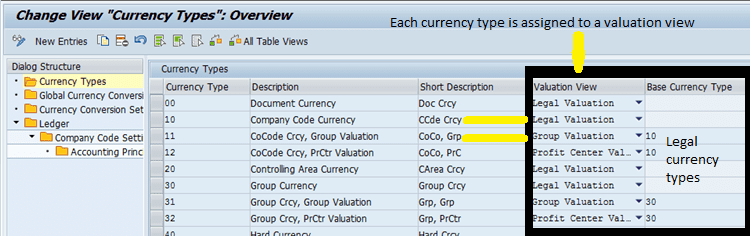

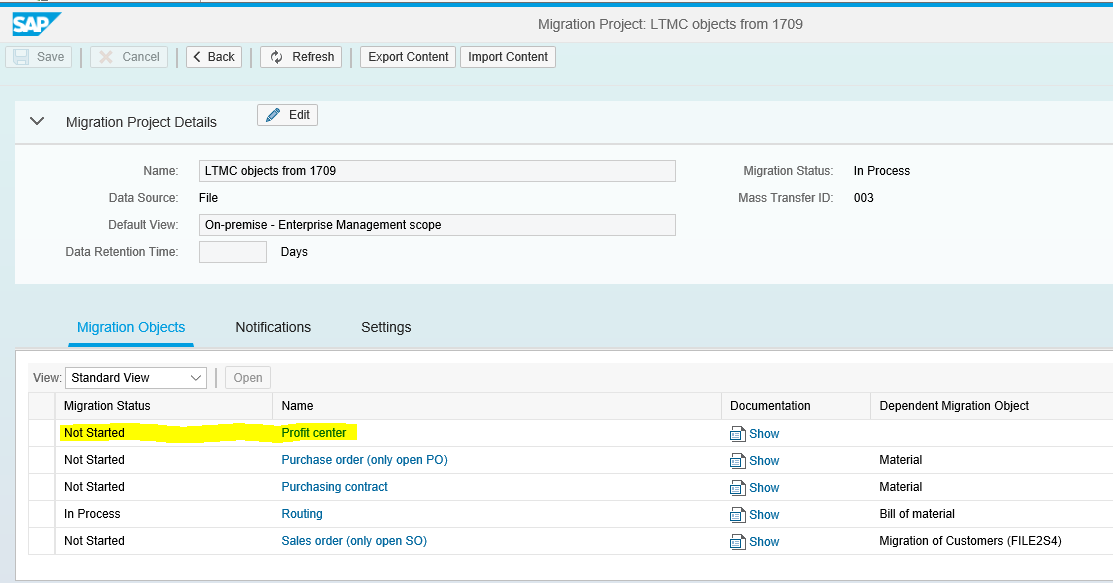

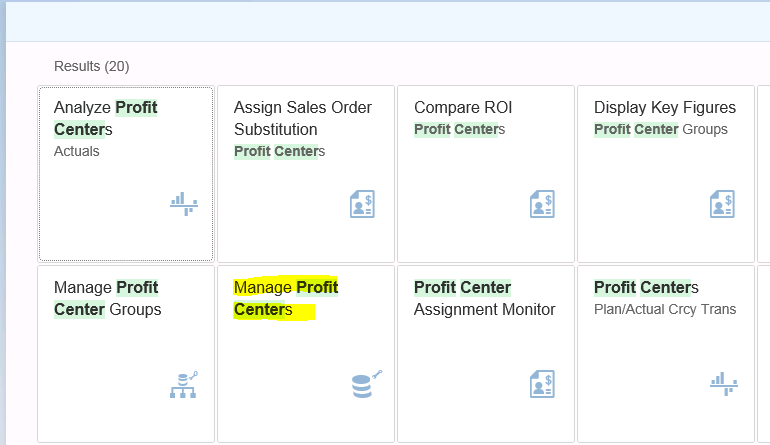

Sap S 4hana Profit Center Accounting Sap Blog Eursap

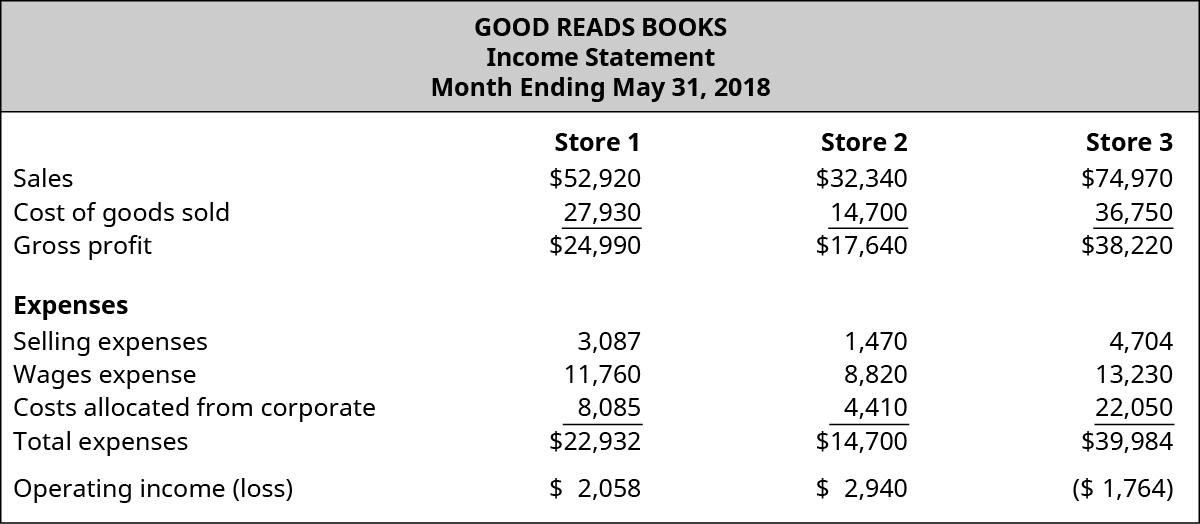

Describe The Types Of Responsibility Centers Principles Of Accounting Volume 2 Managerial Accounting

Pin On Trade Show Reports Data

Describe The Types Of Responsibility Centers Principles Of Accounting Volume 2 Managerial Accounting

Describe The Types Of Responsibility Centers Principles Of Accounting Volume 2 Managerial Accounting

Sap S 4hana Profit Center Accounting Sap Blog Eursap

Article Wash Groom Barn Builders Horse Barns Equestrian Facilities

Browse Our Sample Of Salon Budget Template For Free Budget Planner Template Excel Budget Template Business Budget Template

Sap S 4hana Profit Center Accounting Sap Blog Eursap

Simple Spreadsheets To Keep Track Of Business Income And Expenses For Tax Time Spreadsheet Budget Spreadsheet Tax Time

Guide To Powerful Proven And Profitable Trade Show Tradeshow Banner Design Trade Show Infographic Marketing

Describe The Types Of Responsibility Centers Principles Of Accounting Volume 2 Managerial Accounting

Comments

Post a Comment